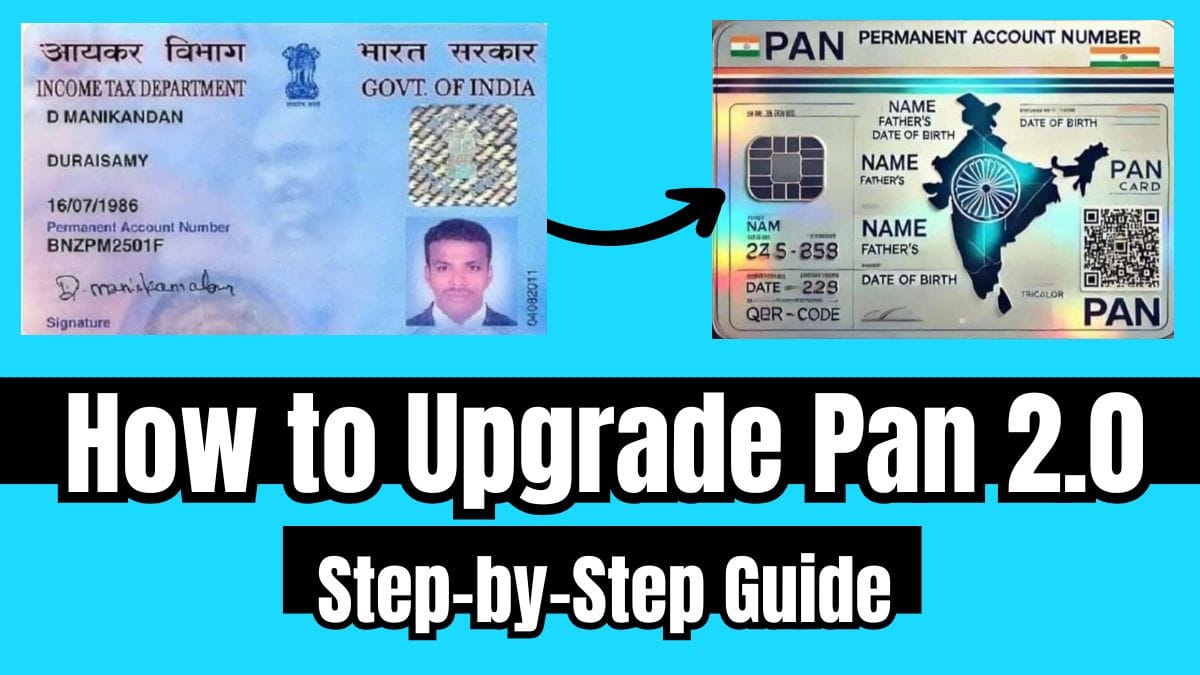

In today’s digital world, having an updated PAN (Permanent Account Number) card is crucial for seamless financial transactions and tax compliance. With the introduction of PAN 2.0, the Income Tax Department has made significant improvements in the way PAN is issued and managed. The new PAN Card 2.0 system offers a more efficient, user-friendly, and secure platform for taxpayers. If you’re wondering how to upgrade your PAN card to PAN 2.0, here’s everything you need to know about pan card update 2.0.

What is PAN 2.0?

PAN 2.0 is a modernized and integrated system for managing PAN and TAN (Tax Deduction and Collection Account Number) services in India. This new version simplifies the process of applying, updating, and managing PAN, making it more secure, paperless, and efficient. PAN 2.0 brings all services related to PAN and TAN onto a single platform, streamlining the experience for users.

Do You Need to Upgrade to PAN 2.0?

If you already have a valid PAN card, you do not need to apply for a new one under PAN 2.0 unless you want to update your details or make changes to your current information. Existing PAN cardholders will continue using their current PAN cards unless they request an update or correction. However, you can apply for a new PAN card with enhanced features like a dynamic QR code if your old card doesn’t have one.

How to Upgrade PAN 2.0: Step By Step Guide

Follow these Steps to Upgrade to PAN 2.0 from your existing PAN card.

Step 1: Visit the Official Portal

The PAN 2.0 system integrates multiple platforms into one unified portal. Visit the official Income Tax Department’s website or the designated PAN service portal.

Step 2: Choose the Option for e-PAN or Physical PAN Card

Once you log into the portal, you will see the option to request an e-PAN or a physical PAN card.

- e-PAN is free of cost and will be sent to your registered email ID.

- If you prefer a physical PAN card, a fee of ₹50 (domestic) will be charged. For international delivery, additional postage costs apply.

Step 3: Fill in the Required Details

You’ll need to provide your personal and demographic details, including your name, date of birth, and contact information. Ensure that the details match those in your Aadhaar card or any other identification document.

Step 4: Submit Your Documents

You may be required to upload specific documents such as your Aadhaar card, proof of identity, and address. The process is fully digital, meaning minimal paperwork is required.

Step 5: Complete the Process and Pay (if Applicable)

After submitting your details, verify the information entered. If you’re requesting a physical PAN card, make the payment as directed. The processing time is significantly faster under PAN 2.0, and you’ll receive your PAN card (either e-PAN or physical) quickly.

Step 6: Receive Your PAN 2.0 Card

Once your request is processed, you will receive an e-PAN at your registered email address. If you requested a physical PAN card, it will be dispatched to your address.

PAN 2.0 Update Link

| Join Telegram | Click Here |

| Direct Link | Click Here |

Key Features of PAN 2.0

- Unified Portal: All PAN-related services like application, update, and verification will now be available on a single platform, simplifying the process.

- Free e-PAN: PAN 2.0 offers free e-PAN services with quicker processing times.

- Enhanced Security: The PAN Data Vault ensures that your personal data is securely stored and protected.

- QR Code: PAN 2.0 introduces a dynamic QR code that allows easy validation of your PAN details. This feature ensures that your PAN card is authentic and contains up-to-date information.

- Paperless Process: PAN 2.0 encourages a paperless approach, reducing the need for physical documentation and making the process more eco-friendly.

What Changes for Existing PAN Holders?

Existing PAN holders do not need to apply for a new PAN card unless they require an update or correction. However, you can opt for a new PAN card with a QR code if your current card does not have one.

QR Code Feature in PAN 2.0

Under PAN 2.0, the QR code on your PAN card is upgraded to display the most current information from the PAN database. This makes your card more secure and easier to validate. When scanned, the QR code will display your photo, signature, and basic details like your name, parents’ names, and date of birth.

If your existing PAN card does not have a QR code, you can request a new one under PAN 2.0. The QR code feature is aimed at improving the authenticity and validation process of your PAN details.

Benefits of PAN 2.0 for Taxpayers

- Quick Processing: PAN 2.0 allows for faster issuance of PAN, reducing the waiting time significantly.

- Cost-Free e-PAN: As part of the new system, e-PANs are issued free of charge, making it a convenient option for most taxpayers.

- Seamless Experience: With all services consolidated onto a single platform, PAN holders can easily access services like PAN updates, corrections, Aadhaar-PAN linking, and more.

PAN Card Update 2.0

PAN Card Update 2.0 features a dynamic QR code for quick verification, a unified digital platform for all services, mandatory Aadhaar linking for better verification, and enhanced cybersecurity. The update is free for current cardholders, and it simplifies the application process. Key benefits include faster verification, eco-friendly operations, and a better user experience.

Conclusion

Upgrading to PAN Card 2.0 is a simple, hassle-free process that ensures a more efficient, secure, and user-friendly experience. PAN 2.0 integrates multiple services into a single unified platform, making it easier for taxpayers to manage their PAN-related tasks. While existing PAN cardholders don’t need to upgrade unless they require updates, applying for a free e-PAN or a physical PAN card with a QR code has never been easier.

Make sure to visit the official Income Tax Department portal to complete the process and enjoy the benefits of the new, enhanced PAN system today!

Pan Card 2.0 Update Kaise Kare

FAQs About PAN Card Update 2.0

What is the PAN 2.0 update?

The PAN 2.0 update modernizes the PAN system, introducing dynamic QR codes, a unified platform, and paperless processes for enhanced convenience.

How do I apply for a PAN 2.0 card online?

Visit the NSDL or UTIITSL portal, fill in the required details, upload necessary documents, and receive your e-PAN via email.

pan card 2.0 update online

PAN Card 2.0 Update Online offers automatic upgrades with a QR code for existing holders and free e-PAN cards for new applicants. To apply, visit the NSDL or UTIITSL portal, enter your details, and receive the e-PAN via email. This update enhances security and simplifies the PAN system through a unified digital platform.

Do I need to upgrade my existing PAN card to PAN 2.0?

Upgrading is optional unless you wish to update your details or get a new card with a QR code.

Is the e-PAN under PAN 2.0 free of cost?

Yes, e-PAN cards are issued free of charge under the new system.

Latest Update

Aadhar Card Mobile Number Check 2024 🔍 | Mobile Number Link to Aadhar Card Online Check

Aadhar Card VS e Aadhar Card: क्या अंतर होता है आधार कार्ड और ई आधार कार्ड में, जाने पूरी जानकारी

आधार यूपीआई बैंक लिस्ट 2024-25 Aadhar Card UPI Bank List 2024

How to Open Aadhar Card PDF: आधार कार्ड पीडीएफ को Open कैसे करें?

Aadhar Card kab Lagu Hua: क्या आपको पता है आधार कार्ड कब लागू हुआ था?, जाने पूरी जानकारी

Aadhar Card 5 to 18 Form PDF: जानें डाउनलोड और आवेदन की पूरी प्रक्रिया

Which Bank Link to Aadhar Card: जाने कौन सा Bank Account Aadhar से जुड़ा हुआ है?

Shubham Kumar currently works in a government position at the block level in his district, where he actively contributes to the administration and public service delivery. Alongside his official duties, he is also a passionate blogger with a deep interest in sharing reliable and up-to-date information on jobs, education, scholarships, and government schemes. His mission is to empower his readers with accurate knowledge, enabling them to make informed decisions, achieve their goals, and lead meaningful lives.